An LLC operating agreement (or LLC agreement for short) is a legal document that establishes the rules, regulations, and provisions for structuring and running your business.

The operating agreement controls the relationship among LLC owners.

It covers matters such as:

LLC members sign operating agreements to declare that they will abide by the agreement's terms.

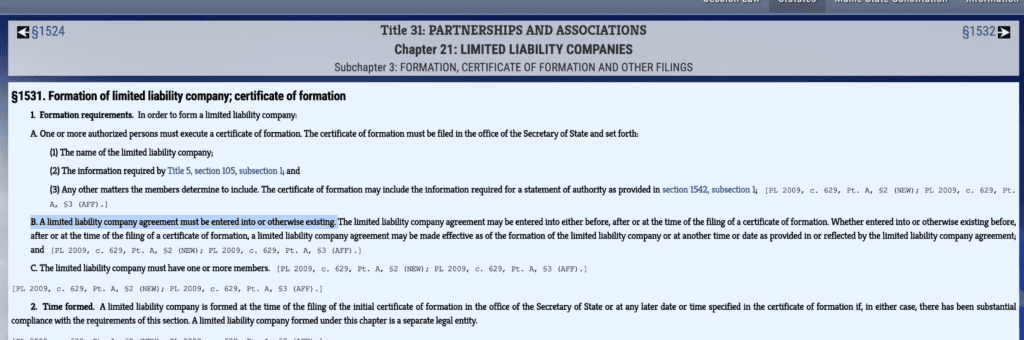

Legally, only 5 states – California, Delaware, Maine, Missouri, and New York – require LLCs to have a written operating agreement.

It doesn’t have to be filed with the state authorities but stored internally. Other states leave this to your judgment. You can have an oral or implied agreement (e.g., members of an LLC accept to be governed by the default LLC state laws).

But without a written and signed operating agreement, you’ll have to adhere to state statutes, which may be vague, subject to change, and not in favor of your issue.

Unlike your Articles of Organization, which you must file with the Secretary of State when forming your LLC, you don’t need to submit an operating agreement with any state governing body.

We recommend checking the requirements with your state’s business registration division so you can stay compliant.

Overall, business owners should create a written LLC operating agreement when:

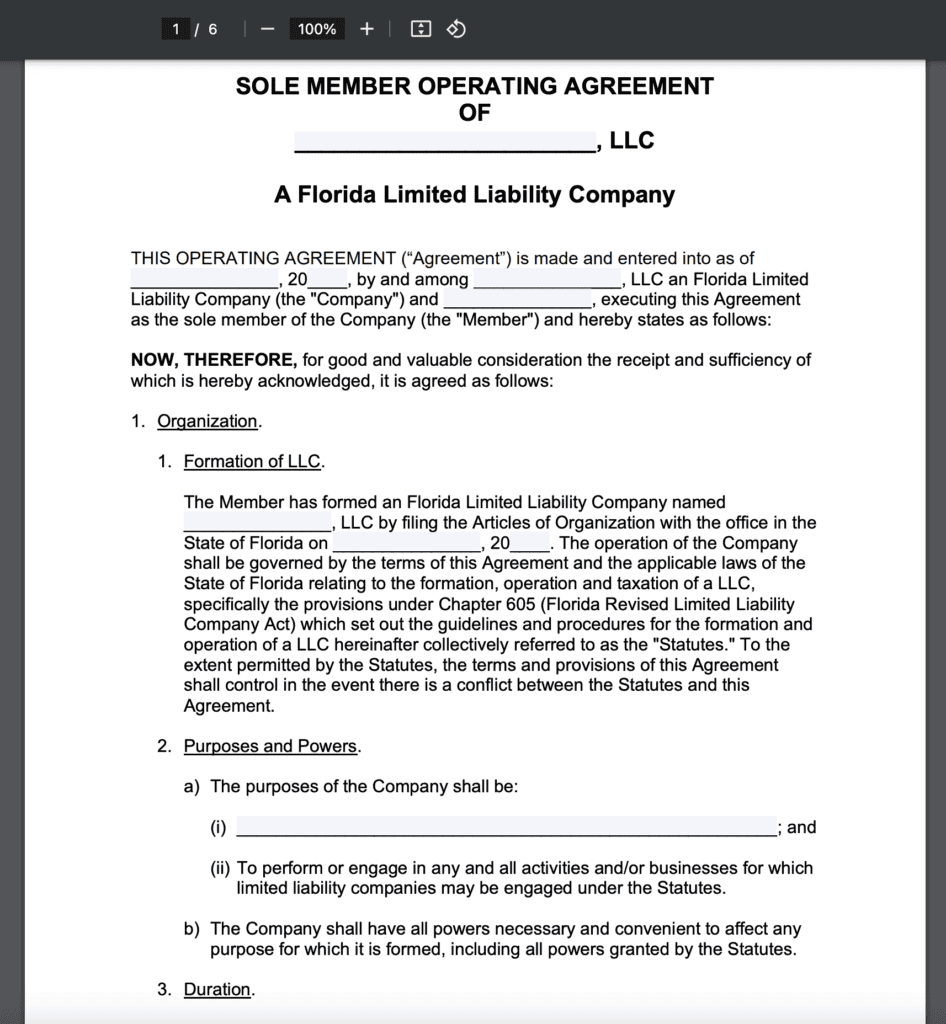

An operating agreement is tailored to your type of business and industry. So no two documents are entirely alike.

But, there are several standard points your operating agreement must cover:

An operating agreement has to open with a general snapshot of your company.

Describe your company's essential characteristics in your operating agreement:

You can also add a line or two about your business’s purpose, industry, and nature (e.g., primary product or service and any other lawful business purpose).

This section states that the operating agreement should comply with the state LLC laws. It also specifies that your business comes into existence once the owner files all proper legal documents with the state.

Your LLC operating agreement needs to list each member and manager’s name, address, title, job responsibilities, and ownership percentages proportionate to their capital contributions.

Specify whether the LLC is a member-managed or manager-managed company. If manager-managed, include the manager’s responsibilities, salary, and employment tenure.

This section defines whether the LLC will be taxed as a sole proprietorship, partnership, or corporation (S-corp or C-corp).

Along with the general information about each member and manager, the operating agreement also has to detail:

Your LLC operating agreement should also define:

Other common types of provisions you should cover in your operating agreement include rules for LLC dissolution, voting rights, and procedures for adding new LLC members.

At some point, you may decide to close your LLC.

Your operating agreement should address this possibility and its implications for other members of the LLC. It should include a plan for the end of your LLC to avoid being forced to adhere to the state’s default rules when dissolving your business. The operating agreement should specify the vote needed to trigger dissolution proceedings, how members will split the LLC’s assets and losses prior to closure, and the wind-down procedures.

At the same time, you may want to add a new member to your LLC or fire someone. Again, your operating agreement must put down the provisions for that.

Procedures like adding/removing members, closing an LLC, or selling it off require a member vote. As do many other operating decisions. Therefore, your operating agreement must explain how members cast votes. Mention:

There are a handful of other provisions you can add to your LLC operating agreement, such as:

Here are answers to several frequently asked questions about LLC operating agreements.

1. Can I create my own operating agreement?Yes. You can use a free online tool to create an operating agreement. However, it’s advisable to consult a lawyer who is an expert on your state’s LLC laws to craft an agreement that will stand up in court.

2. Does an operating agreement need to be notarized?No, your LLC operating agreement doesn’t need to be notarized. It’s a legally enforceable document even without notarization. However, if you want to make things feel more official, you’re free to have all the LLC members’ signatures notarized.

3. Do I need an operating agreement to open a bank account?Depending on your bank. Some may require an operating agreement for a multi-member LLC to open a business bank account and forgo the requirement for single-member LLCs. Others only ask for this document for lending purposes, e.g., to open a credit card or issue a loan.

4. How much does a lawyer charge for an operating agreement?Hiring a corporate attorney to draft an operating agreement can be pricey. Some law firms charge an hourly rate, while others charge a flat fee between $350-$5,000 or more depending on whether you have a single-member or multi-member LLC.

Still, if you want your business and personal assets better protected, a custom agreement will serve you better than any free operating agreement.

5. Can an operating agreement be amended?Yes, you can amend your operating agreement at any time. All owners of an LLC need to approve and document the changes, noting that you’re modifying the existing agreement.